Are You Dealing with Debt Right Now?

We've all been there. Being in debt is no fun and leads to additional worry that results in more poorly thought-of decisions. It's time to break the chain and finally do something about it.

If you're drowning in debt, it might be time to consider streamlining your finances. Nowadays, many people turn towards personal loans to help consolidate debts and get themselves out on firmer financial footing again.

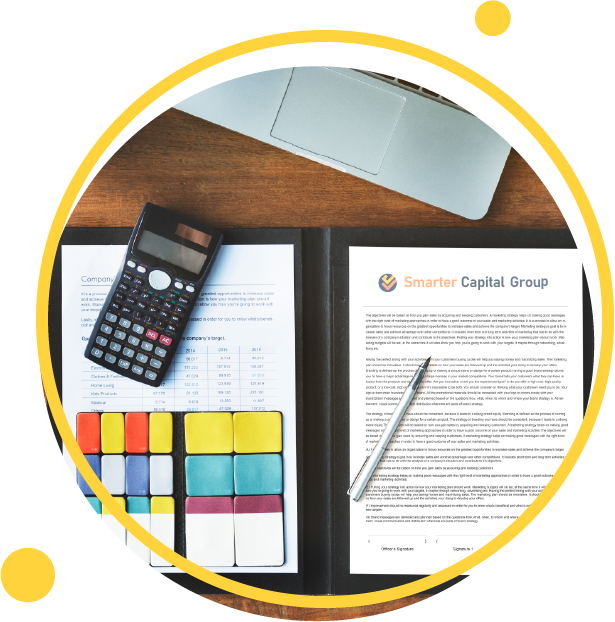

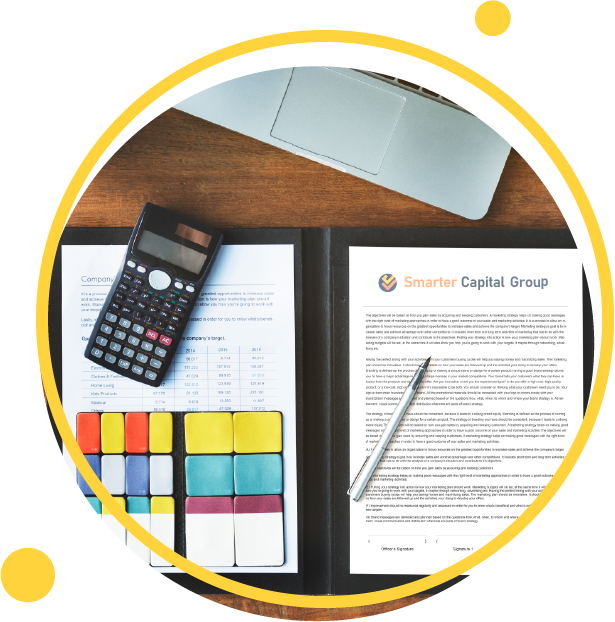

With Smarter Capital Group's quick application process, you could be pre-approved for a personal loan in as little as five minutes.

Expert Solutions You Deserve.

We work hard to make sure our customers get the best experience possible. So you can rest easy knowing that when you choose us as your loan provider, you'll be getting an incredible customer experience from start to finish:

Lower Rates - We have a reputation for getting our clients the best prices available, and we can do the same for you.

Trusted Brand – We're focused on one goal: to deliver expert and reliable service so you can get out of the financial rut you're in.

Speed – If we've recognized that a personal loan is the best option for you, you can expect to receive the money that you need in just days. We have a high approval rating, and we can get your request approved in just 24 hours.

Get a loan for the things that matter most to you.

Use the money you get from your loan for whatever purpose is vital to you – whether it's paying off debt, medical expenses, or home improvements. With our quick approval process and flexible terms, we ensure that every dollar counts toward something meaningful for you.

Debt Problem

We understand how debt and financial problems can stop you from reaching your goals. That's why we offer fast, easy loans to help get you back on track. Our online application process takes less than a few minutes, so there's no need to worry about wasting time or money. Plus, our rates are competitive– so it'll be easy for you to find a plan that works for your budget.

Home Improvement

Let us help you finance your next renovation. Use your loan for anything from new windows and doors to kitchen or bathroom renovations –even landscaping projects. It's the perfect solution if you need more cash than what's in your bank account, but doesn't want to take out a second mortgage on your house.

Home Improvement

Let us help you finance your next renovation. Use your loan for anything from new windows and doors to kitchen or bathroom renovations –even landscaping projects. It's the perfect solution if you need more cash than what's in your bank account, but doesn't want to take out a second mortgage on your house.

Debt Consolidation

You won't have to worry about juggling multiple bills or making numerous payments on time anymore. We can also eliminate those pesky late fees that come with missing payments – because we know how important punctuality is to you. With our services, you will be able to save money and stay out of debt forever.

Debt Consolidation

You won't have to worry about juggling multiple bills or making numerous payments on time anymore. We can also eliminate those pesky late fees that come with missing payments – because we know how important punctuality is to you. With our services, you will be able to save money and stay out of debt forever.

Healthcare Financing

We know you have enough to worry about without having to think about your finances. That's why we work as fast as we can to get you the money you need. If your insurance doesn't cover everything, we will! So you can focus solely on your road to recovery.

Healthcare Financing

We know you have enough to worry about without having to think about your finances. That's why we work as fast as we can to get you the money you need. If your insurance doesn't cover everything, we will! So you can focus solely on your road to recovery.

Other Ways that You Can Use a Personal Loan

Whatever the goal is, we'll always have something for you.

The beauty of personal loans is that they're very versatile. You can use them however you want, whenever you want to. There are no limitations when it comes to the consumption of the funds you receive from us. Some of the scenarios that you can use it for are:

Unplanned Emergencies

Life happens. Sometimes it's a broken blender. Other times it's an unexpected medical bill or a car repair. Whatever the case may be, you can use your loan from us to cover unplanned emergencies and get back on track with your life.

Finance Huge Purchases

We get it. You're a big spender. So whether you want to buy a car or finance your next vacation, our loans are here for all your large purchase needs. We offer loans with low rates, flexible terms, and no hidden fees so that everyone can afford them.

Cover Moving Costs

Moving can be expensive. Our low-interest loans don't require collateral, so you can use the additional funds to cover moving costs, security deposits, new furniture, or even down payment on a house.

Our Process

Our process is simple: let us know what you need and choose a loan option that best fits you. A loan from our company is the perfect solution for any situation. We make it easy to get a quick and straightforward process so that you can have your money in no time!

Convenient Loan Options

The best approach to paying off your debt is the one you can afford. We make sure our terms work for you and your budget with our flexible payment options.

Pre-Qualified Rates in Minutes

We offer fast and easy loans so you can get back on your feet in no time. Our team of experts will work with you to find the perfect loan that fits your needs, and we’ll do it all in just minutes.

No Upfront Fees

Apply for a loan and never pay another cent. No hidden costs or surprises, just the interest rate on your total credit line.

Funding for over $10,000

Whether you're planning a vacation, renovating your home, or paying off debts, we can help.

Use our calculator

to see how much you would be saving.

Use our calculator

to see how much you would be saving.

Get the money that you need minus the headache.

The sooner we get started working together, the sooner things get done for you. This is why we make sure that every step of the process is done seamlessly. So get in touch with our team today!